The 1031 Exchange, named after Section 1031 of the Internal Revenue Code, offers a unique opportunity for real estate investors to defer capital gains taxes when selling investment properties. This powerful strategy allows individuals to reinvest the proceeds from the sale into a new property, enabling them to enhance their investment portfolio without the immediate tax burden. Understanding the intricacies of a 1031 Exchange can be the key to unlocking significant financial opportunities and growing wealth through real estate.

In this article, we will delve into the fundamentals of a 1031 Exchange, exploring its advantages, the eligibility criteria, and the critical timelines involved in the process. Whether you’re a seasoned investor or a newcomer to the real estate market, grasping the essential elements of a 1031 Exchange can empower you to make informed decisions that can optimize your real estate investments and contribute to long-term financial success.

Advantages of a 1031 Exchange

One of the most significant advantages of a 1031 Exchange is the ability to defer capital gains taxes, which can be a substantial financial burden when selling investment properties. By reinvesting the profits into a like-kind property, investors can effectively postpone these taxes, allowing their investment capital to grow uninterrupted. This strategy not only enhances cash flow but also provides the flexibility to diversify one’s portfolio or upgrade to larger and potentially more lucrative properties. Additionally, the 1031 Exchange can facilitate estate planning, as heirs can inherit properties with a stepped-up basis, thus reducing their own tax liability.

Understanding the Rules

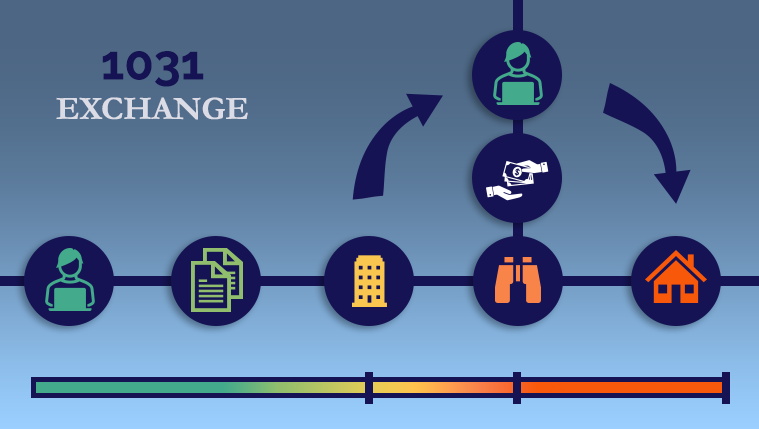

Navigating the rules and timelines of a 1031 Exchange can be complex, but it is essential for maximizing its benefits. To ensure compliance, investors must adhere to specific guidelines, such as identifying a replacement property within 45 days and completing the exchange within 180 days. Moreover, it’s crucial to understand any changes that may have occurred regarding 1031 exchanges, which can impact investment strategies. For detailed insights on these complexities, refer to What Are the Current 1031 Exchange Rules. Being informed about these regulations can empower investors to execute successful exchanges and avoid pitfalls that may arise from misunderstandings or mismanagement of the process.

In conclusion, leveraging a 1031 Exchange can be a transformative strategy for real estate investors seeking to optimize their investment journeys while minimizing tax liabilities. By understanding the rules, timelines, and advantages inherent in this exchange, investors can not only expand and diversify their portfolios but also pave the way for future financial growth and legacy planning. As the real estate market evolves, remaining knowledgeable about the mechanics of a 1031 Exchange will ensure that investors are well-equipped to navigate their opportunities and challenges successfully, ultimately allowing them to reap the long-term rewards of their investment endeavors.